Global Trends in Agro Commodities for 2025–2026: Navigating Price Volatility and Demand Shifts

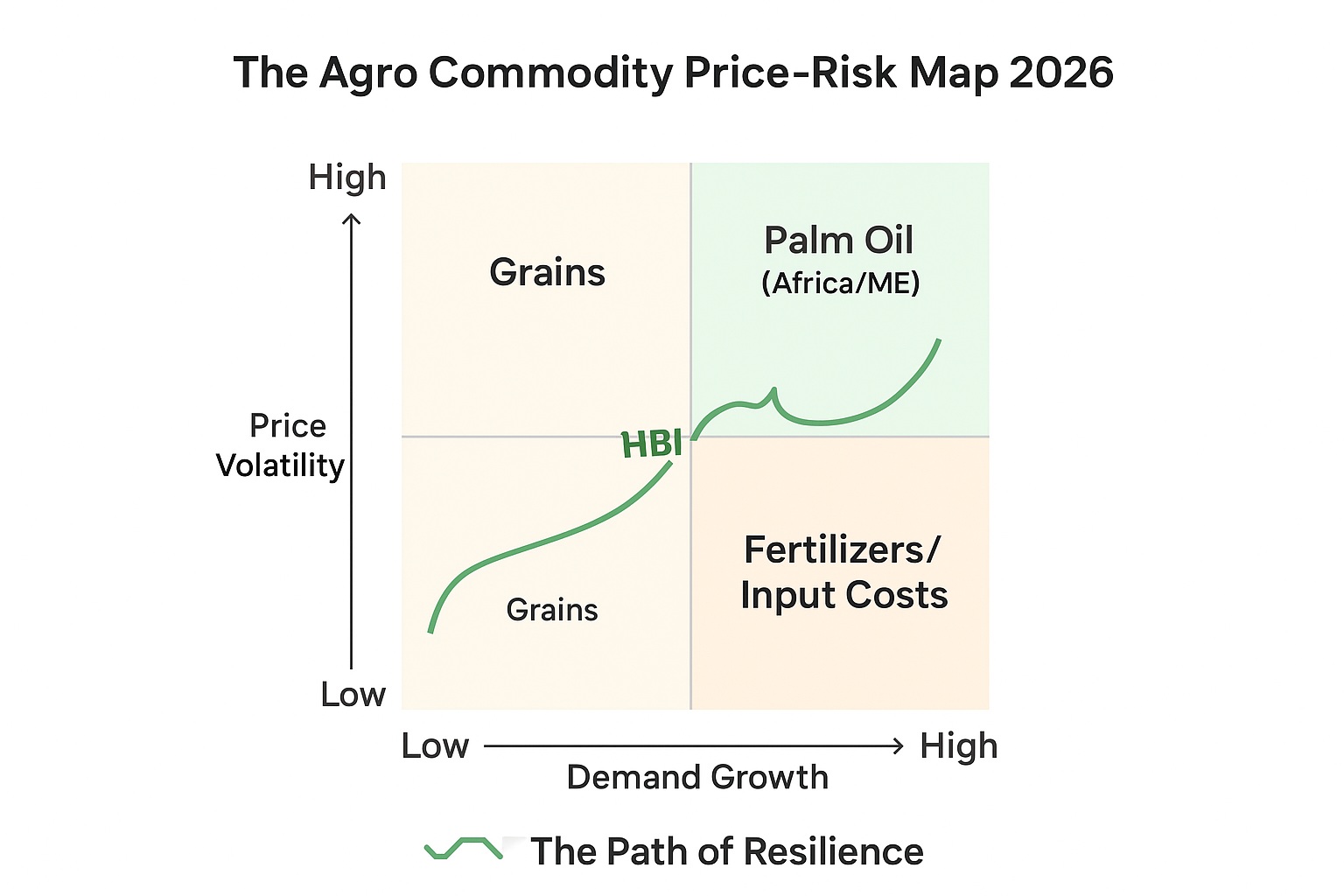

The agro commodity landscape in 2025-2026 will be defined by two conflicting forces: overall price stabilization for key staples due to supply recovery, contrasted by extreme, localized volatility driven by intensifying geopolitical tensions and climate shocks.

For global importers, this environment turns supply chain certainty into the ultimate competitive advantage. Success no longer hinges on achieving the lowest price, but on strategic sourcing, robust risk mitigation, and verified quality control.

At High Business International, our thesis is simple: effective risk mitigation starts with superior market intelligence. Here is HBI Group Asia’s analysis of the global trends shaping the next two years and our strategy for building a resilient supply chain.

Section 1: Price Trends & Volatility Forecast (2025-2026)

Staple Commodities: Stabilization is Fragile

World Bank and FAO forecasts suggest prices for major staples like rice, corn, and wheat are set to stabilize or decline slightly as global harvests recover. This offers a potential respite from the inflationary pressures of the preceding years. However, this stability is highly localized.

Input Costs & Soft Commodities: Persistent Volatility

The cost of essential inputs, notably fertilizer, is projected to remain volatile or even surge due to geopolitical factors and trade restrictions. These rising input costs put immense pressure on farmer profitability and can quickly translate into higher commodity prices or, critically, incentivize suppliers to cut corners on quality.

The HBI Insight: When margins shrink, the risk of fraud increases. This heightens the need for HBI’s 5-point quality control process to verify quality before and during shipment.

Section 2: Global Demand Market Shifts

Africa: The Urbanization & Staple Demand Surge

Rapid population growth and urbanization, particularly in West and East Africa, are driving massive, structural demand for imported staples, especially rice and palm oil. Production shortfalls in Africa relative to demand mean these nations will rely heavily on ASEAN exports. HBI Group Asia is positioned as the verified gateway connecting high-quality Southeast Asian supply to this surging, vital African market.

Middle East & Europe: The Quality and Specialized Focus

Demand in the **Middle East** is focusing on reliable, large-volume sourcing to ensure national food security, prioritizing refined products and stable supply routes. **European** demand, however, is increasingly strict, prioritizing certified, traceable, and sustainably sourced commodities. HBI’s meticulous oversight ensures your supply not only arrives on time but meets these stringent, complex market requirements.

Section 3: HBI’s Strategy for Geopolitical Risk Mitigation

The Threat of Trade Walls and Export Bans

Political instability and resource nationalism lead to sudden, disruptive export bans. The single most effective mitigation tool is **diversified, pre-vetted sourcing.** HBI maintains established relationships across multiple, geopolitically diverse ASEAN countries, ensuring that if one supply route closes, alternatives are verified and operational.

Climate Change: Locking in Supply Certainty

The unpredictability of climate change makes long-term supply planning a challenge. To combat this, HBI utilizes continuous, on-the-ground monitoring and strategically places long-term contracts with established, resilient suppliers. This high-level supervision is a standard feature of our Cooperate Gold Program.

Verification is the Foundation of Trust

In a volatile market, the reliability of your supplier is everything. Our focus remains on rigorous verification—not just inspection—of a supplier’s legal standing, physical inventory, and processing capability. This strategy forms the bedrock of our fraud prevention framework and client success.

Learn more about HBI’s layered fraud prevention: Read the Verification/Fraud Post.

The global agro commodity market for 2025–2026 presents both challenge and immense opportunity. By leveraging HBI Group Asia’s market intelligence and end-to-end operational control, you transform volatility from a threat into a strategic advantage, ensuring your supply chain remains resilient and profitable.